DENAGO EV Financing with Bad Credit – Best Deals, Services & Options Available

Understanding DENAGO EV Financing with Bad Credit – Is It Even Possible?

Can I Get Approved for DENAGO EV Financing with Bad Credit?

If you’re worrying whether your credit score is holding you back from enjoying your own electric golf cart, you’re certainly not alone. One of the most common questions we receive at TIGON Golf Carts is: “Can I get DENAGO EV financing with bad credit?” The good news—yes, it’s definitely possible! Many lenders and dealerships understand that credit situations are complex, and they’ve rolled out flexible financing solutions for buyers with a range of credit profiles. You aren’t locked out of the game just because your score isn’t perfect.

Here’s the reality:

- Many lenders work specifically with buyers with lower credit scores.

- Special programs exist for first-time buyers and those rebuilding credit.

- Your options may include both in-house and third-party financing.

- Short approval processes can help you get behind the wheel of a DENAGO® cart sooner than you think.

How Does Bad Credit Affect My Financing Options?

With DENAGO EV financing with bad credit, you can expect a few hurdles, but nothing you can’t jump. Lenders typically review your:

- Credit Score & History

- Income & Employment Status

- Debt-to-Income Ratio

Even so, bad credit doesn’t mean no options. Instead, it may slightly influence your:

- Interest rate (typically higher for lower credit scores)

- Down payment requirement (expect a bit more up front)

- Term length or loan amount (may be adjusted to fit your risk profile)

Many TIGON customers with less-than-stellar credit still qualify for compelling offers—especially when shopping for models like the DENAGO® EV NOMAD and the premium DENAGO® EV ROVER XL6. We’ll show you how to make lenders see potential—not just the score.

What DENAGO EV Financing with Bad Credit Looks Like Today – Options & How to Qualify

What Types of Lenders Offer Bad Credit DENAGO EV Financing?

No two buyers are exactly alike—and neither are their credit situations. That’s why the market for DENAGO EV financing with bad credit offers variety. Here’s a quick rundown of the main sources:

- Direct Manufacturer-Backed Financiers: Many leading DENAGO® dealers partner with specialist lenders or offer their own in-house financing, often including bad credit solutions.

- Credit Unions & Local Banks: Sometimes willing to look past pure score and consider your story, especially for regional buyers.

- Online Lenders & FinTechs: Quick online applications with rapid answers—these players can provide near-immediate financing, even if your history is bumpy.

- Buy Here, Pay Here (BHPH) Programs: Some dealerships let you pay directly over time—no external banks to navigate! These can be especially friendly for rebuilding credit.

If you’re aiming for

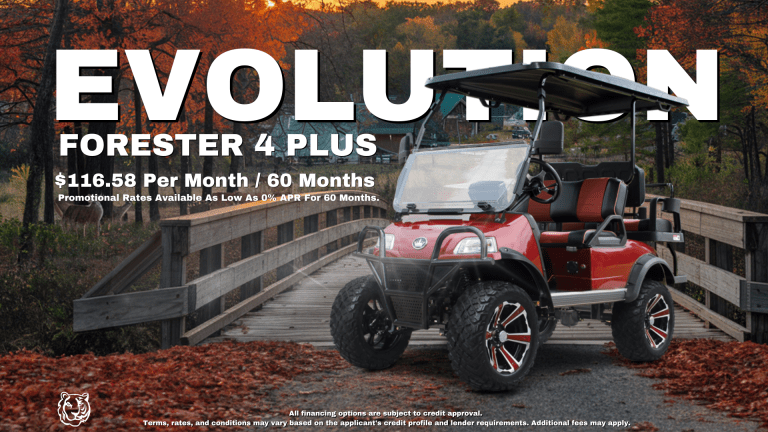

GET THE GOLF CART LSV AT THE RIGHT PRICE!

Tigon Golf Carts proudly offers 0% Vehicle Financing, making it easier than ever to own your dream golf cart. With flexible payment options and competitive rates, we ensure that Upgrading or Purchasing for the first time is not only exciting but also financially feasible for our customers, allowing you to hit the road in style without breaking the bank.